Saturday, 27 July 2024

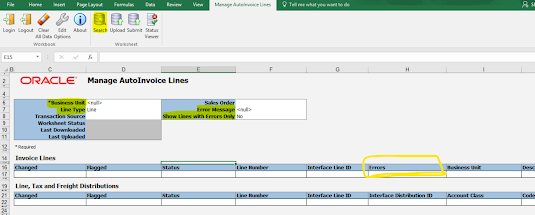

Autoinvoice exceptions in Oracle Cloud

Finance Consultant by profession but traveller||Foodie by choice. I love to travel different place and explore new thing. Love eating as well

Finance Consultant by profession but traveller||Foodie by choice. I love to travel different place and explore new thing. Love eating as well

Wednesday, 17 July 2024

How To Reconcile Account Receivables to General Ledger in Oracle cloud

Account Receivables to General Ledger Reconciliation

The reconciliation of Accounts Receivable (AR) to the General Ledger (GL) is a crucial financial process that ensures the accuracy and integrity of financial reporting. This process involves matching the detailed records of accounts receivable with the corresponding entries in the general ledger to identify and resolve discrepancies.

Now let us see how we reconcile accounts receivables to the general ledger in Oracle Cloud

Below are the high-level steps for accounts receivables to general ledger reconciliation in Oracle Cloud

1. Prepare Receivables to General Ledger Reconciliation Process

Obtain the AR sub-ledger, which includes all outstanding invoices, credit memos, and payments.

Ensure the sub-ledger is up-to-date with all transactions recorded for the period being reconciled.

Log into Oracle Fusion Applications

Home page>Tools-->Schedule Process

Submit 'Prepare Receivables to General Ledger Reconciliation'

This program extracts and prepares transaction and accounting information needed to reconcile Receivables with General Ledger.

Ensure to run this process before starting the Receivables to General Ledger Reconciliation. Verify that the process and sub-processes complete with a status of ‘Succeeded’.

2: Run the Receivables to Ledger Reconciliation Report from receivables work area

Home screen-> Receivables > Account Receivables

Click the Task Pane: Accounting > Receivables to Ledger Reconciliation

you will be able to see the receivables to general ledger reconciliation report which will show all the balances along with the differences.

3. Match Balances:

Compare the total balance of the AR sub-ledger with the corresponding AR account(s) in the GL.

Investigate any discrepancies between the two balances by clicking on the difference amount.

4. Identify Discrepancies:

- Analyze common causes of discrepancies, such as:

- Timing differences (e.g., transactions recorded in different periods)

- Errors in data entry or posting

- Unrecorded transactions or adjustments

- Duplicate or omitted entries

5. Resolve Discrepancies:

- Review detailed transaction reports from both the AR sub-ledger and the GL.

- Correct errors in either the sub-ledger or the GL.

- Record any necessary adjusting journal entries to align the balances.

How To Reconcile Account Receivables to General Ledger in Oracle Cloud

Account Receivables to General Ledger Reconciliation in Oracle

Finance Consultant by profession but traveller||Foodie by choice. I love to travel different place and explore new thing. Love eating as well

Finance Consultant by profession but traveller||Foodie by choice. I love to travel different place and explore new thing. Love eating as well

Sunday, 30 June 2024

Dynamic Discount in Oracle Cloud/Fusion Finance

Dynamic Discount in Oracle Cloud/Fusion Finance

Dynamic Discounting in Oracle Cloud

Key Features of Dynamic Discounting in Oracle Cloud Finance:

Dynamic Discounting in oracle cloud - Comparison to Standard payment terms

How Dynamic Discounting works in oracle cloud/fusion finance

Benefits of Dynamic Discounting in Oracle Cloud/Fusion Finance:

- Cost Savings: By taking advantage of early payment discounts, organizations can significantly reduce their procurement costs.

- Improved Supplier Loyalty: Faster payments improve supplier satisfaction and loyalty, leading to more favorable terms and stronger partnerships. Offering early payment discounts strengthens supplier relationships by providing them with quicker access to funds. Improved payment practices can lead to better terms and collaboration with suppliers, fostering long-term partnerships.

- Enhanced Cash Flow: Dynamic discounting helps organizations manage their cash flow more effectively, ensuring they have the liquidity needed for other strategic investments.

- Operational Efficiency: Automation of discount calculations and payments reduces manual workload, minimizes errors, and enhances overall operational efficiency.

Dynamic Discounting in Oracle Cloud| Dynamic Discount in Fusion finance

Finance Consultant by profession but traveller||Foodie by choice. I love to travel different place and explore new thing. Love eating as well

Finance Consultant by profession but traveller||Foodie by choice. I love to travel different place and explore new thing. Love eating as well

Sunday, 16 June 2024

Artificial intelligence(AI) in Oracle Fusion Cloud Finance

Artificial Intelligence(AI) Features in Oracle Fusion Cloud

Artificial Intelligence(AI) Features in Oracle Fusion Cloud Financials/Finance

- Automated Invoice Processing: Uses machine learning to automatically capture, recognise, and process invoices using the IDR (Intelligent Document Recognition) process.

- Expense Reporting: AI-powered tools automate expense report creation, categorization, and policy compliance checks using Oracle Digital Assistant.

- Cash Flow Forecasting: AI algorithms predict future cash flows based on historical data and current financial trends using Predictive cash forecasting.

- Revenue Forecasting: Utilizes predictive models to forecast future revenue, helping businesses plan and strategize more effectively using Auto-predictive planning.

- Defaulting codes: Reduce manual work in invoice entry and speed up processing using Intelligent Account code combination defaulting.

- Dynamic discounting: Dynamic discounting is an arrangement for early payment in exchange for a discount on the invoice amount. In dynamic discounting, the supplier can provide a discount on the invoice if the buyer pays early. The buyer may choose to accept the discount and effect an early payment. The buyer can also propose to make an early payment in exchange for a discount. It is basically a negotiation between the traders to get better credit terms. The discount provided can be fixed or varying. In a fixed discount, the buyer can pay anytime within the agreed time frame and enjoy a fixed discount. In varying discounts, the percentage of discounts reduces as time passes. The earlier the payment done, the higher is the discount. Dynamic discounting is typically applied on an invoice-by-invoice basis, with the discount generally expressed as a percentage of the payable value of the invoice.

Some of the key benefits of Artificial Intelligence in Oracle Fusion for Financials/Finance

Finance Consultant by profession but traveller||Foodie by choice. I love to travel different place and explore new thing. Love eating as well

Finance Consultant by profession but traveller||Foodie by choice. I love to travel different place and explore new thing. Love eating as well

Thursday, 13 June 2024

eInvoicing for Saudi Arabia In Oracle Fusion Cloud

eInvoicing for Saudi Arabia In Oracle Fusion Cloud

eInvoicing for Saudi Arabia In Oracle Fusion Cloud

- Phase 1 (Generation Phase): Effective from December 4, 2021. Businesses are required to generate and store electronic invoices and notes.

- Phase 2 (Integration Phase): Effective from January 1, 2023. Businesses must integrate their e-invoicing systems with ZATCA's platform.

- Electronic invoices must be generated in a structured format (e.g., XML) or an unstructured format (e.g., PDF/A-3 with XML embedded).

- The invoices must include mandatory fields as specified by ZATCA.

- Seller's and buyer's name, address, and VAT registration number.

- Invoice date and unique invoice number.

- Description of goods or services provided.

- Quantity and unit price of goods or services.

- VAT rate and amount for each line item.

- Total amount payable inclusive of VAT.

- Invoices must include a QR code for simplified invoice validation.

- Digital signatures may be required to ensure the authenticity and integrity of the invoices.

- E-invoices must be stored electronically and be accessible for at least 6 years.

- Invoices must be stored in a tamper-evident format to prevent unauthorized alterations.

- Businesses must integrate their systems with ZATCA’s platform for real-time or near-real-time invoice reporting.

- The system should be capable of generating unique cryptographic stamps.

- Standard Tax Invoices: Issued for B2B transactions. Must include all mandatory fields and the QR code.

- Simplified Tax Invoices: Issued for B2C transactions. These also need to include a QR code but have fewer mandatory fields compared to standard tax invoices.

- Systems must comply with the technical specifications outlined by ZATCA, including API standards for integration.

- The system should be able to handle different types of VAT rates, discounts, and other commercial terms.

- Non-compliance with e-invoicing regulations can result in penalties, including fines and other administrative actions.

- Businesses are encouraged to train their staff and ensure that their systems are ready for compliance with e-invoicing requirements.

- For more detailed and updated information, it is recommended to refer to the official ZATCA guidelines and consult with local tax advisors.

Solution: - eInvoicing for Saudi Arabia In Oracle Fusion Cloud

- Create Invoices: Generate invoices in Oracle Fusion as usual, ensuring that all required information, such as customer details, itemized charges, VAT amounts, and invoice dates, are accurately entered.

- Tax Compliance: Verify that VAT and other applicable taxes are correctly calculated and reflected on the invoices.

- E-Invoice Generation: Use Oracle Fusion’s e-invoicing features to generate the invoice in the required electronic format (typically XML or JSON). This may involve using a specific e-invoice template compliant with ZATCA standards.

· Middleware system – Oracle Integration Cloud (OIC)

OIC will receive the invoice data from Oracle Fusion in addition to this it generates UUID, Invoice counter value, previous invoice hash and invoice hash values to the invoice data and converts the file into ZATCA acceptable format

Integration with ZATCA Portal:

API Integration: Implemented API integration between Oracle Fusion and the ZATCA e-invoicing portal. Oracle Fusion may need to connect with ZATCA’s system using APIs to upload invoices directly.

Finance Consultant by profession but traveller||Foodie by choice. I love to travel different place and explore new thing. Love eating as well

Finance Consultant by profession but traveller||Foodie by choice. I love to travel different place and explore new thing. Love eating as well

Popular Posts

-

Oracle Fusion AR Transaction Approval Setup – Step-by-Step Guide (2025) Learn how to configure Accounts Receivable (AR) transaction approv...

-

Difference between Accrue on receipt and Accrue at period end In the complex world of Oracle Financials and Supply Chain Management, manag...

-

Oracle Fusion Receivables Prepayments: Complete Guide to Setup, Create & Apply Managing customer advance payments efficiently is a corn...

-

IDR vs Document IO Agent in Oracle Fusion: What’s the Difference and Which One Should You Use? Introduction : IDR vs Document IO Agen...

-

Mandatory OUM documents for Oracle Cloud Implementation Mandatory OUM documents for Oracle cloud Implementation In this post we will s...

-

How to Change Asset Categories in Bulk in Oracle Cloud ERP What is “Mass Change Category” in Oracle Fixed Assets? The Mass Change Category...

-

How to Create an ESS Job for a BI Report in Oracle Fusion How to Create an ESS Job for a BI Report in Oracle Fusion If you are working wi...

-

Oracle Document Sequencing: Automatic, Gapless & Manual Numbering Explained Understanding Oracle automatic and gaplesss document sequ...

-

Oracle Intelligent Document Recognition (IDR): AI-Powered Invoice Automation in Fusion Cloud Oracle Fusion IDR (Intelligent Document Recogni...

-

How to read MT940 bank statement format How to read MT940 bank statement format In this post we will see in detail how to read a MT940 bank ...