COGS Recognition Process In Oracle Cloud

Understanding What is COGS in Oracle Cloud

COGS stands for "Cost of Goods Sold." It is a financial accounting term that refers to the direct costs incurred by a company in producing the goods or services it sells. COGS (cost of good sold) includes expenses such as the cost of raw materials, labor, manufacturing overhead, and other costs directly associated with producing the goods or services.

COGS (cost of goods sold) is an important metric for businesses, as it is used to calculate the gross profit, which is the difference between the revenue generated from sales and the direct costs of producing those goods or services. Gross profit is a key indicator of a company's profitability and financial performance. By tracking COGS, businesses can assess the efficiency of their production processes and pricing strategies, and make informed decisions about pricing, inventory management, and profitability. COGS (cost of goods sold) is typically reported on a company's income statement or profit and loss (P&L) statement as a separate line item.

COGS (Cost of Goods Sold) and Revenue Accounting in Oracle fusion/ cloud

In Oracle Cloud, Cost of Goods Sold (COGS) can be tracked and accounted for using the Oracle Cloud Financials module, specifically the Inventory Management and Costing functionality. The Oracle Cloud Financials module provides robust accounting capabilities for managing and tracking COGS in a cloud-based environment.

Below are the steps which need to be performed to recognize COGS (cost of goods sold) and Revenue in oracle cloud

- Complete the sales order

- Ship the goods and materials

- Once the goods and materials are shipped Import the invoice into accounts receivable (AR) by running Autoinvoice Import

- Recognize the revenue in accounts receivables by running Recognize revenue job

- Post the invoice to GL

- Run "Transfer Transactions from Inventory to Costing" Job

- Run "Transfer Transactions from Production to Costing" Job

- Run "Transfer Transactions from Receiving to Costing" Job

- Run "Import Revenue Lines" Job

- Finally run the job "Create Cost Accounting Distributions process with COGS Recognition enabled"

1) Complete the sales order

- No accounting entries are generated at this time

2) Ship the goods and materials

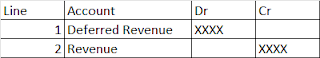

4) Revenue Recognized in Accounts receivables

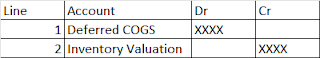

5) Final entry generated when cogs recognition processes are run in cost management

Cost of Goods Sold (COGS) Recognition Process In Oracle cloud

Cost of goods sold(Cogs) and revenue accounting is an critical aspect of Revenue and COGS recognition process in any business and plays very crucial role in the organization’s/business financial statements. In the above section we have seen what is cogs recognition process in oracle in details and when/how accounting entries are generated for it.

No comments:

Post a Comment